Q4 2025 SUPPLY CHAIN MARKET INSIGHTS

A Look at the Supply Chain,

Transportation & Logistics Industry

The commercial freight transportation landscape continues to evolve rapidly amid shifting market dynamics, regulatory changes, and emerging operational challenges. If you’re feeling whiplash, our market report is here to help. As we approach the final quarter of 2025, this report provides an in-depth look at the current state of the industry with a focus on key trends affecting all sides of logistics.

This quarter, we’re focusing on demand fluctuations, regional capacity constraints, regulatory enforcement, and seasonal weather events playing pivotal roles in shaping freight movement and cost structures. As always, we’ll share additional resources like industry surveys and research, so you have a comprehensive overview crucial for strategic planning and operational resilience in the months ahead.

Be sure to subscribe so you don’t miss an update.

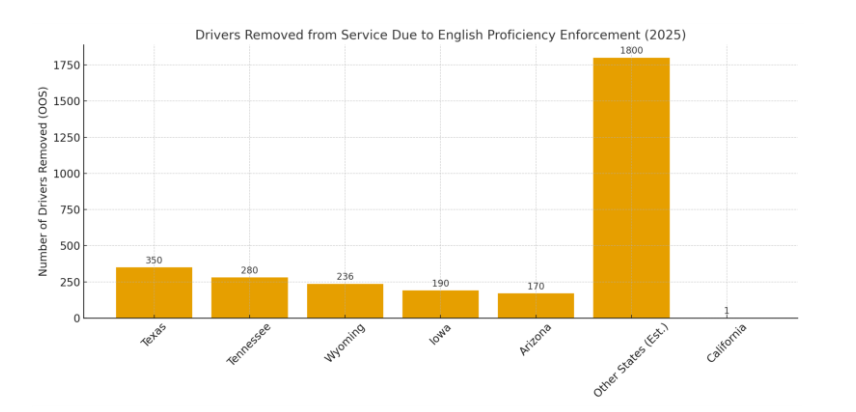

The DOT’s focus on enforcement of English Language Proficiency* rules for commercial truck drivers is starting to show results and impact.

Since the enforcement focus began in June 2025, more than 3,000 commercial drivers have been placed out-of-service due to insufficient English proficiency. Safety is the goal, but the changes have created supply chain disruption, operational cost increase, and business interruptions for carriers and drivers. As well, enforcement varies by state, with Texas taking 350 drivers off the roads, and California with one.

These removals occur during roadside inspections and traffic stops. Inspectors give instructions in English and assess the driver’s understanding; if a driver cannot adequately respond in English, they are issued an ELP violation and immediately placed out of service (prevented from driving) until the issue is remedied.

In October, a joint operation between ICE agents and the Oklahoma Highway Patrol held from September 22 to 25 resulted in the arrest of 91 commercial drivers who were then put out of service. Of the 91 commercial drivers detained, 39 were citizens of India, 13 of Uzbekistan and 12 of China. ICE revealed that 80 of the 91 drivers had entered the U.S. illegally or were awaiting asylum hearings, while one had a final removal order.

In September, Florida launched immigration checks at state weigh stations and Rep. Byron Donalds (R-Florida) introduced the Weigh Station Enforcement to Intercept and Guard Highways (WEIGH) Act in the U.S. house. If passed, the bill would codify and enforce the ELP executive order by requiring that “all weigh stations along all interstate highways review the Commercial Driver's Licenses (CDLs) of truckers for irregularities and verify the English language proficiency of truckers.”

The additional screenings and increased inspection volume have created backups at Florida weigh stations and agricultural checkpoints, causing traffic and on-time shipment delays for commercial traffic entering or traveling through the state.

If passed, and all U.S. weigh stations become ELP checkpoints, there is fear and uncertainly as to how the OTR supply chain will be affected, as well as specifically cross-border shipping along the Mexico border. The Port of Laredo is the largest international trade port in the U.S. and the busiest inland port along the U.S.-Mexico border.

Key Recommendations for Shippers

- Double down on brokers like Mariner that aggressively vets its carrier network. Carriers with ELP violations had crash rates nearly twice the national average (for DOT‑recordable crashes) compared with carriers without such violations.

- Take weigh station delays into account when planning Florida shipments to set expectations with both customers and distribution centers.

Golden Week, one of China’s most significant national holidays, will take place this year from October 1–8. During this time, we can expect that most factories, businesses, and government offices will be closed or operating at reduced capacities. The holiday is a week-long celebration commemorating the People’s Republic of China in 1949. When the holiday is over, it can create unique challenges for the global supply chain. Please be sure to reach out to the Mariner International team for support!

A recent report by Splash247.com revealed that the movement of empty containers accounted for 41% of global transport in July 2025, up from 31% in 2019, a steady increase over the past five years. According to experts at Sea-Intelligence, this trend stems from structural trade imbalances, as some regions consistently export far more than they import, while others remain import-driven. The result is an uneven distribution of equipment: some ports are overflowing with containers, while others struggle with severe shortages.

Matthew Burgess, Vice President of Shipco Transport, noted that North American ports routinely face a surplus of containers due to imports significantly outpacing exports. The repositioning of empties is not only costly but also a major factor contributing to port congestion and delays.

Industry analysts also point to the ongoing Red Sea crisis, which has now stretched close to 700 days without resolution, as another key driver. With carriers forced to reroute and travel longer distances, equipment availability has tightened further, amplifying global supply chain challenges.

Starting October 14, 2025, new Section 301 port fees will be phased in on Chinese-built and operated vessels, following a ruling by the U.S. Trade Representative (USTR). The USTR determined that China’s shipbuilding policies create economic security risks and negatively impact U.S. companies and the domestic economy. As a result, vessels owned or operated by Chinese entities will face significant new port fees—potentially reaching millions of dollars per voyage, depending on vessel size and ownership structure.

The fees will start at $50 per net ton and rise annually, reaching $140 per net ton by April 17, 2028. The measure is designed to protect the U.S. shipbuilding industry and ensure fair competition in global maritime trade.

Maersk, the world’s second-largest ocean container line, has confirmed it will not impose surcharges on shippers when new U.S. port fees targeting China’s maritime sector take effect.

Other major players are responding differently. Seaspan, the world’s largest independent container ship owner, is preparing to relocate its headquarters from Hong Kong to Singapore and reflag 100 vessels. Meanwhile, members of the Ocean Alliance, including CMA CGM and COSCO, have stated they also do not plan to levy surcharges. China’s largest carrier, OOCL, has echoed the same position, though one analysis projects the new port fees could cost the company up to $2.1 billion in 2026.

Some carriers are reportedly exploring options to reassign tonnage away from China, though concrete strategies have not been confirmed. With policies still unfolding, the industry faces considerable uncertainty about how carriers will ultimately adapt.

As we wrap up 2025, the brokerage landscape feels less about dramatic swings in rates or capacity and more about steady shifts in expectations. Shippers are leaning more on tech, regulators are tightening the rules, and broker relationships are evolving. It’s not about what’s “hot” this quarter, it’s about what’s changing for the long haul.

Regulatory Shifts: Cleaning Things Up

The FMCSA is continuing its push to bring more transparency and accountability to the brokerage world. One proposal on the table would require brokers to share documentation like rates and payment info with carriers if they ask for it. It hasn’t passed yet, but it’s a sign of where the industry is headed: toward more open, documented transactions.

Another change that’s already in motion is the consolidation of broker and carrier identification numbers under the FMCSA’s Unified Registration System (URS). Instead of having separate MC and broker authority numbers, everything’s being rolled into one ID. The idea is to cut down on confusion and help prevent things like double brokering, which, according to FreightWaves, reached record complaint levels this year.

For shippers, both of these changes are good news. They help simplify the process, reduce risk, and make it easier to tell who you're actually working with. At Mariner, we’ve already got systems in place that support clear documentation and real carrier vetting, so we’re aligned with these changes, not playing catch-up.

Tech Expectations Are Growing

The bar is higher now. More shippers are expecting brokers to plug directly into their TMS or ERP systems via API or EDI, rather than relying on emails and spreadsheets. It’s not just about convenience; tighter integrations mean faster responses, fewer errors, and better planning on both sides.

Visibility is also a big piece of the puzzle. According to FourKites, only about 68% of brokered loads had full tracking coverage this year. That stat alone shows that while most brokers say they provide visibility, many still haven’t fully closed the loop.

For our customers, we’ve seen that visibility and integration aren’t “nice to haves” anymore. They’re expected. And when done right, they reduce stress and save time for both our team and yours.

Customer Trends: Fewer Brokers, Better Fit

We’ve also seen a shift in how customers are choosing partners. A recent Gartner survey showed that more than half of shippers cut down on the number of brokers they work with this year. That aligns with what we’re hearing: shippers want fewer handoffs, more consistency, and partners who understand their business, not just their lanes.

In other words, reliability is winning out over sheer capacity. Having 10 brokers on speed dial doesn’t help much if you’re constantly chasing updates or fixing issues after the fact. What matters is who can deliver when it counts and who actually communicates along the way.

Looking Ahead to 2026

As we head into the new year, the market feels more mature. Rates and demand may shift, but the fundamentals are changing: shippers want clean processes, trustworthy partners, and tools that actually work.

At Mariner, we’re not trying to be everything to everyone, but we are doubling down on being a consistent, tech-capable partner that’s easy to work with and ready for what’s next.

Mariner is a global 4PL partner leading with technology integration to connect shippers to their entire global supply chain. We manage the design, build, execution and measurement of a shipper’s end-to-end global logistics network, working with the shipper to coordinate logistics operations via internal and/or external parties.

By working as a true partner, Mariner helps drive growth and value by leveraging logistics expertise, buying power, and cutting-edge technology with transparency at every step.